As many economies emerge from the most restrictive periods of lockdown, thoughts are steadily turning to “what’s next?”. In this latest blog from our COVID-19 tracker series, we’ll review the priorities of businesses on their road to recovery.

Business decision-makers have room to think about the future again

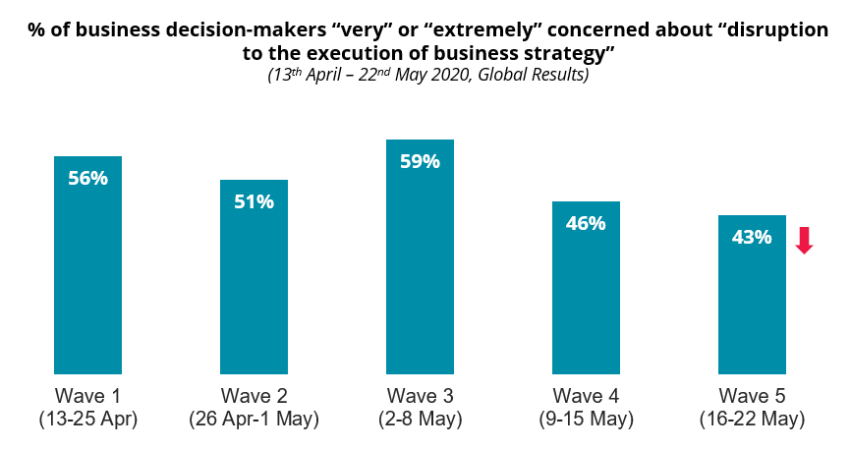

Data from our latest wave of research shows an abatement in concern about business strategies being disrupted due to COVID-19: The chart below shows that in our latest week of data, those expressing high levels of concern about this issue has fallen to 43% among business decision-makers. This is from a high point in the mid-to-high 50% range only a few weeks earlier. Tentative signs are that businesses are turning their thoughts to recovery:

Further, the above downward trend is clear in all three of the geographical regions we cover in the study: Americas, Europe and APAC. Likewise, both SMEs (companies with fewer than 250 employees) and Enterprises (those with 250 or more) also show this same pattern. So there’s genuine cause to think we may now be moving to a new “phase” from a business perspective.

Customer Strategies: 4 main themes emerge

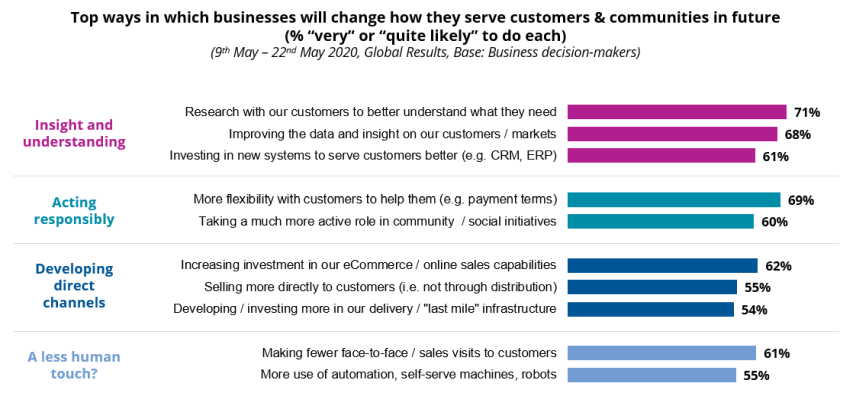

With this context in mind, what are the top priorities of commerce as it begins to navigate the “new normal”? To this end, we asked firms about how their approach to business may need to change – especially in terms of how they serve their customers. The chart below shows a summary of the main themes and issues to emerge:

Our results show 4 clear themes pulling through in terms of anticipated changes to customer strategy:

-

Insight and understanding of customers: The strongest and most consistent actions relate to businesses improving the depth of understanding that organizations have on their customers and markets. Given the profound changes that COVID-19 has brought to the circumstances of many customers, suppliers will need to “right size” their offerings in line with new customer needs.

Allied to this, strong levels of interest in CRM also suggest the need to better operationalize customer and market insights (e.g. through increased personalization of experiences). What is notable is that the intent to invest in back-office systems was especially high among more industrial firms, such as manufacturing (where 74% stated it was a likely action).

-

Acting responsibly: The communications of major consumer brands have placed strong emphasis on “being there” throughout the crisis. But how sincere is this? When we look more broadly across the business community, there does appear to be a genuine desire from firms to act responsibly as stakeholders in wider society. This includes taking a more active role in community and social initiatives, for instance (mentioned by 60%).

At a practical level, this also includes seeking to provide greater flexibility to customers, where possible (mentioned by 69% as an action likely to be taken) – for example, through greater forbearance in terms of payments.

-

Developing direct channels: As we’ve previously reviewed in this blog series, supply chain challenges during COVID-19 have been a major issue – particularly issues related to deliveries and getting products to customers when relying on partners or distribution. What is clear from our data is that there is a sub-set of businesses that are seeking to exercise greater control over their own destiny in this regard.

62% of firms state that they’re likely to further develop their eCommerce and online sales capabilities, while 54% potentially intend to invest in and build out their own delivery / “last mile” infrastructure in the future.

-

A less human touch? Our final theme concerns a topic that’s been on the agenda of business for several years – the increased role of automation and remote working. 61% of all the firms surveyed anticipate making fewer face-to-face visits to customers in future, while 55% intend to make greater use of automation and self-serve technology.

It is worth noting, however, that this potentially less “human” approach to business is not an approach that all see virtue in: Only 36% of SMEs (<250 employees) stated that greater automation / self-serve would be a likely priority. Similarly, only 43% of decision-makers in business and professional services firms stated that it was likely that they would develop opportunities here.

Post-COVID marketing strategies reflect a renewed focus on customer experience

Looking beyond broader business initiatives, we also asked companies taking part in our survey about their marketing strategy plans moving into 2021. The table below shows the top 5 strategies that are anticipated to be pursued among Enterprises that have b2b customer bases (that is, those that sell to other companies):

Out of over 15 different marketing strategies presented, there was a high degree of consistency globally and between regions in terms of top priorities among larger b2b firms:

-

Customer experience: Linked to the trends seen earlier in this article, customer experience and loyalty figures very prominently, and is the top strategy in Americas and Europe.

-

Product development / innovation: This ranks within the top 3 priorities of every region. This is very likely linked both with product innovation and improvements to organizations’ customer service approaches that we outlined earlier. This is encouraging, as innovation might possibly be expected to be an area where spending is stripped back in a crisis. This re-invigoration of R&D spend is perhaps seen most clearly in the pharmaceutical industry right now, where research spending by biopharma companies has increased 13% year-over-year in Q1 2020.

-

Extending reach – looking to new sectors and territories: As demand falters in markets closer to home, it is natural for companies to look to new opportunities. This takes two forms – Diversification into new industries (a priority in all regions) and exploration of opportunities in new countries / territories (seen more prominently in Europe).

-

Strongly different priorities across the funnel by region: This is most evident between Europe and APAC – In the former, bottom-of-funnel and conversion activity will be a priority next year. For APAC, the emphasis is instead very strongly on top- and mid-funnel activity (awareness-raising and brand positioning).

These findings are from the B2B International COVID-19 Tracker. They are derived from n=2,030 interviews with business professionals in SME and Enterprise firms in the UK, France, Germany, USA, Canada, China, Singapore, Australia and Japan. Fieldwork was conducted from 13th April – 22nd May 2020.