Brand Positioning Research

How Can Brand Positioning and Perception Research Help?

68% of B2B buyers agree that the brands they see at work all sound and act the same. With buyer expectations increasing rapidly and the gap to the competition narrowing, building a strong B2B brand is essential. Brand positioning and brand perception research helps your brand to stand out from the crowd and resonate deeply with customers.

Establish Brand Perceptions

Determine Points of Differentiation

Map Positioning in The Market

Trusted Research Partner for Top B2B Brands

Why Partner with B2B International for Brand Positioning Research?

A Project as Unique as Your Business

Trusted B2B Data Quality

Action-Orientated & Outcome-Focused

Speak to One of Our Brand Positioning Research Experts

Want to discuss how brand positioning and brand perception research could benefit your business? Get in touch to schedule an introductory call with one of our team.

Contact UsA Complete View of Brand Positioning and Brand Health

Our proprietary Brand Health Wheel captures how well your brand is executing on awareness and usage, brand positioning, and brand delivery, against individually-agreed KPIs. The framework can then be used to strengthen brand building efforts, while also guiding improvements to marketing and messaging.

The visual nature of the Brand Health Wheel makes it an appropriate framework to share with leadership and business teams as a quick and easy-to-interpret summary of a brand positioning and brand perception research study.

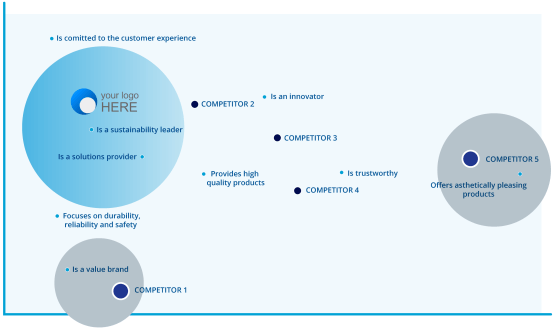

Visualizing Brand Perceptions and Identifying Whitespace Opportunities

Brand positioning and perception research helps you understand what your brand stands for, its essence, and its core values. Brand mapping based on correspondence analysis will be used to understand which brands share a similar position and which brands are differentiated in the eyes of the market.Video: The Right Way to Measure Top-of-Funnel Performance in B2B

A video is being shown

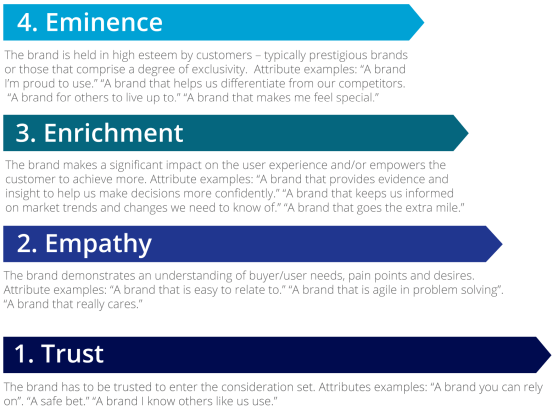

Measuring Emotional Attachment with Your Brand

Through our research, we have identified four different levels of emotional engagement. We can assess which brands in your portfolio are positioned on which steps of the ladder (as well as any which do not emotionally engage with the market in a meaningful way).

Armed with this understanding, companies can avoid cannibalization by aligning each brand with a specific market segment, while also striving to create stronger emotional connections with the market through each of its brands.

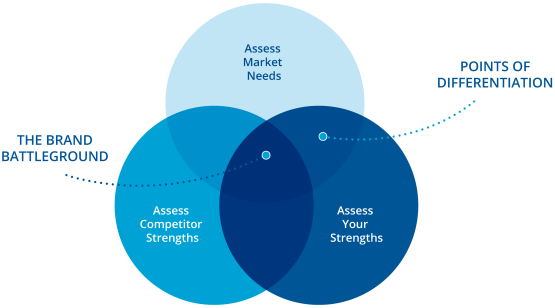

Identifying the “Sweet Spot” for Your Brand Positioning

The Three Circles Framework is used to highlight your brand’s strengths, the market’s needs, and the perceived strengths of competitors to determine the “sweet spot” in which to position your brand in the most effective way, ensuring it resonates with the market to ultimately drive brand growth.Helping GEALAN to Understand and Strengthen its Brand Position

Business Challenge

GEALAN is one of the leading suppliers of PVC-window profiles in Germany and Europe. The company supports its customers with innovative solutions and excellent services, not only concerning the product, but also through helpful information materials.

Through continuous market observation and anticipation, GEALAN was able to make decisions about which customer groups to prioritize in its communication and sales strategy.

However, there was a lack of externally validated insights to ensure that the content of marketing communications, the channels used, and the brand positioning strategy were helping to build on the strong position in the market.

Therefore, GEALAN decided to set up a market research project with the overall objective to build more differentiated customer communications and services that could meet the needs of not only their buyers, but also the end customers. The client placed particular importance on mapping as accurate a perception of the brand in the market as possible to be able to identify opportunities for further development.

What We Did

GEALAN approached us to investigate the German market with a particular focus on four of their most important target groups. Of particular interest was:

- How customers become aware of the supplier

- What criteria is used to select the supplier

- Which channels are used to gather information about the supplier

- How their customer is perceived in the eyes of the target groups

- What are their competitive advantages in the market

Assuming that the end customers, i.e. the buyers of the final product, and their preferences regarding the product features could influence the decisions of the direct buyers, GEALAN was also interested in getting to know the decision-making processes of the households better.

A total of 300 B2B decision-makers were interviewed (manufacturers, retailers, and architects), as well as 200 households who had recently made a decision about buying windows.

In the case of the households, the survey was conducted online, which allowed for a MaxDiff approach to gain an accurate insight into decision criteria related to the selection of windows. In this method, the respondent is prompted to weight between the most important and least important decision criteria accordingly.

The analysis of the data from the telephone interviews (CATI) of the three direct target groups was complemented by a regression analysis, which made it possible to identify the most important drivers in the selection of a supplier. In these and other attributes, we were able to compare the performance of GEALAN’s brand with that of their key competitors, and thus map their general position in the market.

Complementary Solutions to Take Your Brand Further

Video: The Right Way to Measure Mid-to-End Funnel Performance in B2B

A video is being shown

Featured Content on Brand Positioning and Brand Perception Research

Speak to One of Our Brand Positioning Research Experts

Want to discuss how brand positioning and brand perception research could benefit your business? Get in touch to schedule an introductory call with one of our team.

Contact Us