When considering the growth strategy of your business, there are several circumstances in which it becomes necessary to evaluate and compare market opportunities. You might be planning the launch of a new product or service – either in a new market, or one that you are already familiar with through your existing business activity. Alternatively, you might be seeking expansion through the introduction of an existing product or service into a new market.

Whatever your goals, there is much to consider when evaluating market opportunities – and several ways in which market research can help you to develop a winning strategy. In this article, we will outline some of the key considerations when it comes to market evaluation, and our top tips for making informed, strategic decisions.

The Size of the Market

One of the first questions you might be asking yourself is: ‘how large is this market for the product / service we are offering?’. Knowing the size of the market can help you to understand whether the market is large enough and profitable enough to be worth exploring further. Additionally, it is important to consider growth rates, i.e. whether the market is moving in the right direction and at a pace that is appealing to you.

Market research – a combination of primary research and desk research – can help to answer this question. Market size is typically understood as the total value or volume of a given market, in a given year, at a given point in the supply chain – so, in order to understand the market size, this work needs to begin with defining what you’re looking for:

-

What market size are you interested in? The Serviceable Available Market (based on your current competencies and channels), or the Total Available Market (considering also your underlying potential?)

-

Which stage of the supply chain are you sizing? For example, which types of company will you be selling to?

-

What specific product(s) / service(s) are you sizing the market for?

With definitions set, there are several ways in which the market size can be calculated. The best market size estimates triangulate from several of these calculations to obtain the most robust possible estimate. You can consider the following as part of this:

-

‘Demand side’: Conducting interviews with a representative sample of end users of the product / service to find out what they spend, then aggregating this data up for the whole market by using data such as the total number of companies that exist

-

‘Supply side’: Assessing the revenue of competitors, and adding it up to obtain an estimate of the existing market value

-

‘Top down’: Identifying the size of a bigger market within which your market is contained, and using this to estimate your own market size by defining your relative position

-

It is also important to consider how your own internal data may add to this picture, e.g. in cases where the product / solution you are investigating is already launched in another market

The Structure of the Market

Having established the size of the market, the next task is to understand the structure of the market. Two elements that are essential to consider when evaluating market opportunities are the existing competitive landscape, the context within which the market operates, and routes to market.

Where possible, it is desirable to understand the competitive landscape in three elements:

-

Market share – what proportion of the market is currently held by each competitor? How has this changed over time – which competitors appear to be growing?

-

Market context – a situation analysis to understand the opportunities and threats in the markets you are interested in

-

Market perceptions – how are the different brands perceived? What are their strengths and weaknesses? What qualities or attributes do each of your competitors stand for?

While desk research is a valuable resource in understanding market share, it cannot take you as far in understanding how brands are truly perceived in the market. To do this, we recommend conducting a market survey with end users and / or potential buyers, to ask for their unbiased view of the key brands they are aware of in this market – including, where applicable, your own.

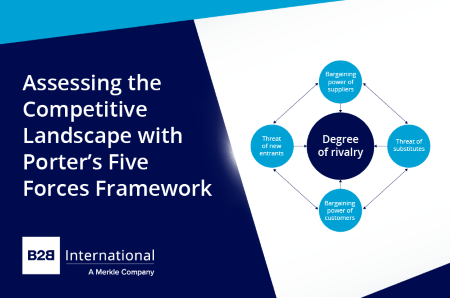

There are several tools and frameworks we can use to help you understand the existing competitive landscape: how brands are perceived and, crucially, what this means for your own brand strategy upon entering the market:

-

Brand mapping: Identifying which brands in the market ‘own’ certain characteristics, and which qualities lie ‘unclaimed’

-

Three circles model: Displaying the intersection of customer needs, your own strengths, and competitor strengths to help understand where your organization would sit among competitors

-

Porter’s five forces: Helps an organization to assess whether the market is attractive to enter, and where the key challenges might lie

Tools like SWOT and PESTLE analysis can help you to understand the context within which the market operates:

-

SWOT: An analysis of Strengths and Weaknesses of your own organization, alongside Opportunities and Threats arising from the wider market

-

PESTLE: Analyzing the Political, Economic, Societal, Technological, Legal and Environmental context and trends within the market to help further understand opportunities and threats that your organization might face

Finally, when evaluating a market, it is also important to understand how the market operates, including the typical route to market. For example:

-

Is the product you are considering typically sold through distributors, or is it purchased directly?

-

Would this be considered a strategic purchase or more of a routine / transactional purchase? In either case – who would be responsible for making the purchase decision? We have conducted numerous ‘path to purchase’ research projects which answer this exact question across a range of industries and geographies.

Buyer Needs and Preferences

Having developed an idea of the size and structure of the market, the third requirement is in understanding how to appeal to buyers in that market. We can already gain a sense of this through research into brand perceptions, but a dedicated piece of research can give you valuable insight into the challenges faced by your target audience, as well as their needs and expectations. These projects might include:

-

Customer needs research – to identify ‘beneath the surface’ customer insights

-

Buyer persona research and development – to bring your target audiences to life and inform your strategy

-

Path-to-purchase research – to understand the most influential factors driving your buyers’ decision making and identify which touchpoints are most critical to success

How to Compare Between Potential Markets of Interest

It is evident that when evaluating a market opportunity – the size of the market, the structure of the market, and buyer needs – you will be faced with a wealth of data! A key skill of any researcher lies in making sense of such data and applying it to business strategy. In our own research projects, we are often faced with the challenge of distilling such data into a clear story of key learnings or recommendations. To get to this point, you can consider:

-

Which market is most appealing?

-

Why is this the case? Is it, for example, to do with size, suitability, current brand position?

-

How should your organization approach this market, whether with an existing product / service or a new one?

Once we’ve compiled all of our data for market assessment projects, we frequently use the Directional Policy Matrix framework to assess overall market attractiveness for our clients. This tool can direct strategy based on the attractiveness of a market and the capability of the organization to fulfil the opportunity. It is most useful when an organization has several countries, products, or segments to investigate – allowing you to compare the relative appeal of multiple markets you may be considering.

In Summary:

When evaluating market opportunities, there are several key research objectives that your organization will need to fulfil in order to make an informed, strategic decision. Market research is an invaluable tool at each stage of this process, combined with your existing knowledge and experience. Whatever you feel the ‘gaps’ in your knowledge to be, we have conducted research projects throughout this entire process and would be delighted to help you complete that final piece of the jigsaw puzzle and help towards your eventual winning strategy.

Readers of this article also viewed:

How Market Research Can Help Guide Your Market Entry Strategy Using the Push-Pull Model to Successfully Bring New Products to Market Assessing Market Attractiveness with the Directional Policy Matrix Competitive Landscape Analysis with Porter’s Five Forces Framework

To discuss how our tailored insights programs can help solve your specific business challenges, get in touch and one of the team will be happy to help.