Recently, when preparing for a presentation, Dan was re-reading some material that suddenly struck him in a different way compared with his previous reading of it. Drawing on original USA research from customer satisfaction surveys the American marketing specialist Jack Trout makes the following points.

- More than 40 per cent of customers who claimed to be satisfied switched suppliers without looking back. (So many choices, so little time.)

- Eighty nine per cent of people who owned cars from a certain manufacturer said they were very satisfied and 67 per cent said that they intended to purchase another car from that manufacturer.

- Fewer than 20 per cent actually did so.

Source: Trout (2000) p 33.

Clearly the above raises interesting questions about the subject of customer satisfaction and it has prompted a very lively exchange of thoughts between the two authors named above. Out of this came the decision to write this short B2B White Paper jointly.

Common sense tells us that if businesses fail to satisfy customers they are unlikely to stay in business very long, unless either (a) they are in a monopoly position with no cost-comparable substitutes or (b) they are the final choice supplier in a sector where every other supplier is experiencing fully utilised capacity that is contractually committed and therefore cannot be released at higher, market-clearing prices. Few organisations nowadays find themselves in this luxurious position. Consequently, as Trout illustrates, the achievement of measured customer satisfaction may not always translate directly into customer retention and profit over time.

Is Everybody Happy?

As a backcloth to this discussion, it is helpful to consider exactly what satisfaction means. If someone asks you if you are very satisfied or quite satisfied with your car, exactly what would be in your mind? Although we all have a general view of what satisfaction means, we know that it means different things to different people. To some it may mean, “it’s OK”; to others it may mean “it fully meets all my expectations”. The word satisfaction is like happiness – it is something we are all interested in and would like to measure but it is a soft factor – one that is hard to quantify.

Another point to bear in mind about these measures of “soft” issues such as satisfaction and happiness is that different groups of people could have different views. We see this in global surveys of happiness. Most Nigerians say that they are happy even though it seems that by comparison to us, theirs is a pretty impoverished lot. Also, when we are measuring soft issues such as satisfaction and happiness, the game keeps moving on. The more we have the more we want. The first time we received free bottles of shampoo and conditioner in a hotel we were very satisfied. Now we take it for granted and expect a bowl of fruit and perhaps a bottle of bubbly.

Happiness levels across the world have been measured for some years and we have seen a steady decline in most countries. For example, in the early 1970s in the UK we could expect around 45% of adults to say that they were very happy. Today that proportion is only 30%.

However, despite the rosy mists of the past, most of us would not want to turn the clock back and live without central heating, suffer cars that rust and constantly break down, and give up our electric windows. According to Professor Daniel Kahneman of Princeton University, measuring happiness is not to be fully trusted. He proposes the concept of “objective happiness” in which he measures happiness regardless of what people say. This is something for us to bear in mind in customer satisfaction surveys – can we find measures that indicate satisfaction without necessarily asking if people are satisfied.

Loyalty Is Stronger In Most B2B Markets

Let us turn the discussion to business to business customer satisfaction. We can recognise that the above forces are also at work here. Suppliers are getting better and better in every way. Deliveries arrive fast and on time, prices are falling, products are more reliable – and yet customer satisfaction levels are stuck at scores of around 8 out of 10 for most companies.

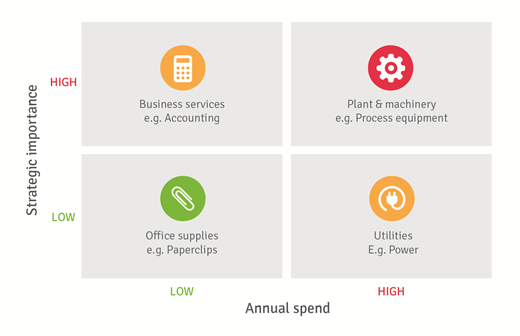

The good news is that the lack of loyalty and degree of supplier switching referred to by Trout is not fully evident (yet) in business to business markets. There are three good reasons for this. Firstly, business to business buyers (remember there is seldom just one person involved – usually a decision making unit) have all to agree in their decision to change their supplier. The “jury” effect of the complex DMU restrains the impulsive actions that we can more easily take as consumers. For us as Joe Public, does it really matter if we buy one brand of shampoo rather than another – but it could matter if we change the brand of lubricating oil in the cutting tool. Buyers are reluctant to make a change to another supplier, ever sceptical that the initial lower prices and promise of better service may evaporate within months. Of course, much depends on the type of product that is being sold – how critical is it to the running of the business? Business to business buyers have some sort of map in their minds that positions the products and services they are buying as critical (or not) to their business. They know when they can chop and change suppliers and when it isn’t worth the risk.

Loyalty Map For Business To Business Products

The second factor that ensures greater loyalty in business to business markets is the “relationship lock-in”. Many of the products that are supplied to businesses involve personal contact with the supplier. We find in survey after survey that customer satisfaction is driven largely by people factors. Friendly, knowledgeable and attentive staff add considerable points to the customer satisfaction score. We have more to say on this later because this is most certainly something that we can influence greatly.

The third factor that ensures relatively high levels of loyalty in business to business markets is inertia. An incumbent supplier to a business has a good chance of keeping that business (unless they screw up badly or if a significantly better offer is made by someone else) because it is just too much trouble to change. Companies, unlike the general public, have a web of knots that tie them into their suppliers. Most suppliers have to go through an approval procedure before they can begin deliveries. Terms of payment and supply agreements have to be set up. Saved dialling numbers to the incumbent supplier simply make it easier to place the order. Getting the paperwork in place is for some companies a sufficient deterrent to leave business where it is unless there is good reason to change.

What does all this mean to us in business to business markets? It seems to us that it poses two important questions:

- Are customer satisfaction scores valid in the form we know them today?

- How can we measure loyalty and use those measures to produce even greater lock in for our customers?

Measuring Customer Satisfaction

In the thousands of studies that have been carried out measuring customer satisfaction in business to business markets, we have learned that there are no magic bullet questions. This is because the answers people give are not always the ones we can believe (remember Professor Kahneman) and the interpretation we make about the answers by relating one to the other can be far more enlightening. In a typical customer satisfaction survey there could be as many as thirty to fifty different rating questions on all the aspects of product, service, value and delivery. However, there are eight questions that seem to be central to the study (with obvious modifications to suit). These questions are:

- How satisfied are you with the quality of the products from ABC Ltd?

- How satisfied are you with the reliability of products from ABC Ltd?

- How satisfied are you with the value for money of products from ABC Ltd?

- How satisfied are you with the sales service from ABC Ltd?

- How satisfied are you with the speed of delivery from ABC Ltd?

- How satisfied are you with the reliability of delivery from ABC Ltd?

- How likely or unlikely are would you be to recommend ABC Ltd?

- How satisfied are you overall with ABC Ltd?

In order that we can relate one question to another and keep a score for benchmarking purposes, we have to record the answers to these questions on a rating scale of one kind or another. Everyone reading this in business to business markets will also see the need for obtaining free ranging responses that help us get behind the numbers.

Question 8 is a vital question as it provides a benchmark for comparing with other suppliers and because we can correlate the answers from the other questions with this score to work out the key drivers of satisfaction. Answers to Question 7 show a strong link with loyalty and propensity to buy in the future.

So, at this point of time we have to say that the questions we are asking are probably the right ones but we must make sure that we leave room for questions that measure loyalty since a satisfied customer can still be at risk from a competitive supplier with a seductive lure.

Measuring Loyalty

In addition to question 7, that determines the likelihood of recommendation, we can ask other simple questions to measure loyalty such “how likely are you to buy from ABC Ltd in the future?”

However, we would like to push the loyalty discussion further as it seems to us that for loyalty to really matter, it should be robust and durable. A supplier with robust loyalty would have forces in place that resist other suppliers breaking in. For example, a good rep who has built strong relationships with all the decision makers in the company may be robust enough to head off threats from competition. A supplier with durable loyalty will keep the business for a long period of time. It seems to us that the achievement of robustness is to do with communication and that the creation of durability relates to alignment with customers’ requirements and their identifiable future needs.

Let us look at the two elements, robustness and durability, in turn.

Robust Loyalty

Robustness is achieved by excelling on the soft issues that can sometimes be overlooked. Branding and positioning play a key role here even though they may not show up as key drivers in the selection of a supplier. They are not the sort of things that business to business buyers acknowledge but we know that they are vital in ensuring a fit between two companies. As customers become more discerning and subjected to more frequent marketing messages, the need for identifiable uniqueness increases, otherwise the outcome is that products and services – and even the organisation itself – become “commoditised”. The essence of a commodity is that it is readily interchangeable with other similar commodities. Therefore the logical consequence of this process is that communicating values that resonate with customers is vital to achieving a robust position.

It can be seen from the above that the key to customer satisfaction over time is to do with not only the deal but also the relationship and that this is not achieved by some static once-for-all set of elements of the marketing mix. It requires a more sophisticated approach. But if this approach can be devised initially and managed against the dynamics of changing customer requirements and competitive pressures, the result is sustainable satisfaction leading to reduction in selling costs since, as marketing specialists are quick to point out, it costs several times less to gain business with the existing customer base than by the constant addition of new customers for the ones that desert.

Different customers feel comfortable with different relationships. We can categorise these as “relationship types”: they function independently of the product and service offering, and this is summarised below. What constitutes customers’ comfort can (indeed must) get re-categorised over time as they themselves change under constantly evolving market- and competitor-driven conditions.

This is summarised in a paper addressing a very different subject – logistics – written recently by Dr John Gattorna, a recognised authority on supply chain design. It illustrates why the technologies of Customer Relationship Management have become so significant, along with the concept and practicalities of Key Account Management.

Since we need to achieve what is explicit in the above, we need to be able to assess the extent to which we meet customer requirements in terms of relationship at the moment.

Durable Loyalty

Concerning durability and the question of meeting customers increasing demands, the key is to move in synchronisation with the customer. Offering a better product or a cheaper product is not always the answer to meeting changing needs, especially if the advantages can be quickly copied. In this respect the tools and techniques of supply chain management, developed initially for the logistics function of business, have a powerful impact on marketing. Competitive advantage can be derived from anywhere in the supply chain, and the basis of competition is moving to one of supply chain versus supply chain rather than product versus product.

Creating and managing the critical value-adding parts of this set of relationships is central to achieving durability.

Durability is not about being ‘built to last’, but about having the capability to change whilst continuing to perform at or preferably above the industry sector average. This is summed up most convincingly in a recent article by Professor Gary Hamel (Hamel 2003). Again, his perspective is not specifically to do with marketing and selling, but what he has to say about the broader subject of business strategy has a valid message for marketers. Hamel’s basic argument is that value is more evenly distributed than in the past due, inter alia, to “technological discontinuities, regulatory upheavals, geopolitical shocks, industry deverticalisation and disintermediation, abrupt shifts in consumer tastes and hordes of non-traditional competitors”. In this the traditional functions of brand, market share, business model, channel to market, first-mover advantage (we could add more) are becoming less effective, since the key to retaining customers is not simply to do more of the same in a better manner but to do it different – as Hamel puts it, “the ability to dynamically re-invent business models…as circumstances change”. We would argue that the sustainability of customer satisfaction is central to this.

In order to assess whether our organisation has the potential for durability (assuming that, on a snapshot view, we are satisfying our customers in terms of product and/or service) we have to answer, quite simply and unemotionally, two questions. The first is “what is our value to our customer within the totality of the supply chain?” The second is “how do we retain and improve this value faster than our competitors can catch up?”

Concluding Thoughts

Companies of all types and sizes need to take a hard look at their approach to analysing customer satisfaction and to measure it in a more perceptive and holistic manner than by asking simplistic questions that give a snapshot view of product and service. For this view can get outdated alarmingly quickly; and sustainable differentiation, as we have argued in other B2B White Papers, is derived increasingly from other parts of the supply chain.

Satisfying customers is a means to an end. The purpose and goal of customer retention are clearly the important issues here. The key is in understanding the nature of the relationship and in anticipating its potential. Not least, it has significant implications for ourselves in B2B, and our B2B approach to analysing customer satisfaction on behalf of our clients and indeed for ourselves is being continuously improved to take these dynamics into account. This puts any business in a better position to reinforce the triangle of satisfaction/robustness/durability, which in turn translates into more effective cost management and revenue/margin growth.

Satisfaction is of limited value if it does not lead to retention. Product and service are no longer enough: relationship is emerging as the bigger differentiator, supply chain lock-in leads to durability of loyalty. The customer satisfaction concept is overdue for a product recall. Are we on board with this?

References

John Gattorna ‘Keynote Address to Logistics Ireland 03’ Mimeo. (Gattorna 2003)

Gary Hamel “The Quest For Resilience” Harvard Business Review, September 2003, pp 52-63. (Hamel 2003)

Daniel Kahneman reference from “How to be happy” By Ed Crooks and Simon Briscoe Financial Times Dec 26, 2003

Jack Trout “Differentiate or Die” New York: John Wiley 2000. (Trout 2000)

Paul Hague

Daniel Park

January 2004

Copyright © P N Hague and J D Park 2004

Paul Hague is founder and Managing Director of B2B International. He is the author of 12 works on market research. Dr Daniel Park is an economist, specialising in business strategy and international marketing. He is an Associate Consultant of B2B International and has authored over 30 publications on aspects of international economics and business.