There is a commonly held view that market research and strategy consulting are highly distinct industries. Traditional market research is understood as the act of gathering information about customers’ needs and preferences. Market research providers are known for their expertise in asking the right questions, using the most suitable methodology and being able to access the relevant audience with the ultimate goal of delivering comprehensive, high quality primary data. Strategic consultants, on the other hand, excel in helping a business make high-level decisions that enable them to increase profitability or outperform the competition.

Nonetheless, compared to b2c projects, b2b market research more often addresses a strategic business need. This can give b2b market researchers access to higher levels of the corporate decision making chain as senior team members are more involved and invested in the project. Many b2b research projects are driven at the boardroom level, both in terms of identifying a need for research and implementing the recommendations. This is most likely because in b2b markets there are a smaller number of strategic customers, purchases are of higher value and products/ services are normally sold through consultative selling rather than mass marketing.

Many b2b clients approach agencies with questions which seek to contribute to strategic objectives. These include:

-

Should we enter this new market?

-

How should our brand be positioned to increase market share?

-

What areas of the business should we invest in order to have the most significant impact on customer experience and thus loyalty and profitability?

-

Which touchpoints on the buyer journey are most critical to success?

-

Should we invest in the development of a new product or service?

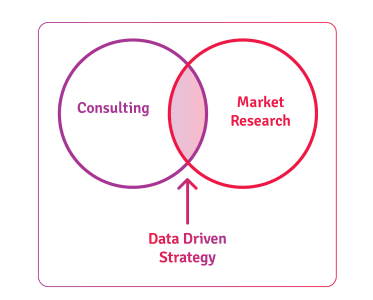

Blurring the boundaries: Data driven strategy

It may be a misconception in the majority of cases these days, but one of the perceived weaknesses of market research is that it is purely a process driven industry associated with collecting data. However, the fact that strategy consultants often do not possess the internal capacity to undertake primary data collection presents an opportunity for market researchers. Market researchers can build upon their core strengths of rigorous data collection and analysis to provide businesses with the clear evidence base on which to make data driven strategic decisions. Through the process of designing the research tools, collecting the information and analysing data collected, an immersive knowledge is developed and recommendations can be be made on a well-informed basis.

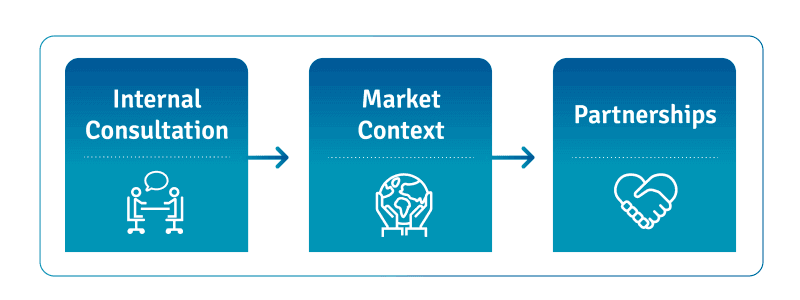

The following are some suggestions as to how market researchers can operate more strategically to blur the boundaries between two historically distinct industries. These suggestions are structured around the stages of a typical engagement: commissioning, research and analysis and the development of recommendations.

International consultation

At the beginning of a project it is important to explore, deconstruct and challenge the assumptions forming the basis for the research rather than simply taking hypotheses and objectives at face value. The can be achieved by conducting an interactive workshop between the research team and project sponsors. A further approach is to seek the views of different stakeholders in an organisation beyond the core project team in order to understand the desired project outcomes from a broader perspective, any potential hurdles to the implementation of recommendations and to improve stakeholder engagement in the process. By conducting internal consultation, the research consultant is able to understand the internal capacity of the client to implement the strategies recommended and ensure that recommendations are aligned with the company’s overarching culture, goals and business strategy.

Taking a consultative approach at the beginning of a project is more related to an inductive, bottom-up mode of reasoning where the objective is less structured around testing defined theories and hypotheses. Even in a project which is by nature structured around highly specific objectives, such as understanding which value proposition resonates most with a target audience, it can be valuable to take a step back and understand the needs of customers and which factors drive their decision to purchase a product or service.

Incorporating the market context

The primary strength of market research is the ability to elicit and understand the views of customers and businesses. However, in order to satisfy customer needs, it is imperative to incorporate a broader understanding of the economic, political and social forces impacting a market which could affect a company’s performance. This can include an investigation of the:

-

Economic environment – such as inflation rate, interest rates, levels of foreign direct investment, distribution and supply chain dynamics and the relative power of suppliers.

-

Political environment – such as new government policies, regulations and tariffs.

-

Technological environment – such as innovations which may disrupt and affect the operation of the industry.

-

Competitive environment – including the current industry rivalry, threat of new entrants and the extent to which the client company is differentiated from the competition.

Incorporating the market context reduces the risk of ‘base rate bias’ slipping into the project, where there is an over reliance on relative rather than absolute results. For example, a project may survey potential customers in order to develop a customer segmentation and offer recommendations as to which segments the client should target. But it is crucial to then go one step further and understand the size of that segment relative to other segments, and as a proportion of the total market. Whilst one segment may seem the most attractive when balancing the views of customers and the client’s ability to meet the needs of those segments, a broader interpretation may reveal the addressable market to be relatively small. Similarly, in new product development research, beyond solely gathering feedback on a new product, the analysis could also consider the total market size of the product and the anticipated market share which the new product could expect to achieve.

The key point here is that the most pertinent insights are generated when researchers thoroughly understand both customer needs and the economic, social and political context in which those customers exist.

Developing partnerships

During the final stages of a project, the typical arrangement is to present research findings and recommendations to the client. However, rather than being structured as a one-way delivery of results, properly interpreting and defining actions emanating from the research can be best achieved as a joint task between the researcher and client. This enables all parties to work in collaboration to action and embed the recommendations into the client’s business. It can also support the development of long term partnerships between market researchers and clients, where the implementation of recommendations is assessed and monitored over the long term. Once a longer term partnership is underway, market researchers can begin to develop a detailed understanding of the client’s business.

In summary, working together with clients to interpret results, prioritise actions and implement business strategies supports a shift from capitalising on data assets to human capital, which can reinforce long term and strategic partnerships.

Summary

The market research industry is in a strong position to capitalise on its core strength of data collection to move towards the provision of ‘strategic insight’. This article has suggested three ways in which this can occur. Firstly, through challenging the objectives of a research project from the outset in order to frame problems more in terms of a business issues. Secondly, by gathering a strong evidence base incorporating an understanding of the market context alongside the views of customers and prospects. Finally, by delivering the findings in a multidirectional manner and forming long term partnerships.

At B2B International all of our research is designed to provide actionable findings which help drive tactical and strategic action and provide insights in a commercial context.

Contact us to find out more on how our market research and consulting expertise can help your business.

Readers of this article also viewed: