Introduction

The data collection methods used by market researchers have changed dramatically over the last two decades. Face to face interviews are hardly ever used nowadays and self-completion postal surveys are nearly extinct. For business researchers, online surveys and telephone interviews are the main data collection methods. This paper examines the use of these two most popular data collection methods in studies of industrial and professional markets.

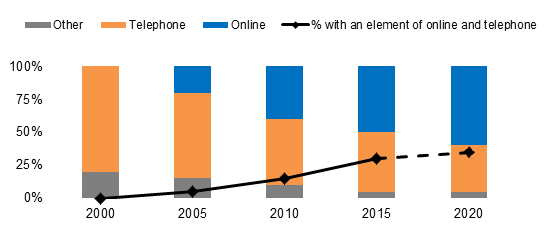

Figure 1: Percentage Of Projects Completed By B2B International By Main Collection Mode Used

Online Versus Telephone; Which Approach Works Best?

The question as to which data collection method works best is very much dependent on four factors:

-

The Project Objectives

The project objectives are crucial in selecting the most appropriate data collection method for a business-to-business research project. Both telephone and online surveys are possible in qualitative and quantitative studies and they have their own strengths and weaknesses.

The telephone is usually a better option for qualitative research, especially when the objectives are explorative. It allows skilled interviewers to guide the conversation by probing and prompting to get the necessary detail and insights. If the objectives require a longer questionnaire (say, one of more than 10 minutes) it generally makes sense to conduct an interview over the telephone as the interviewer can keep the respondent engaged and interested. The telephone is also the better option when there are specialist and complicated topics as is often the case in business-to-business studies. Over the telephone the interviewer can make sure that the respondent understands the questions and can probe to ensure a full understanding is obtained of the answers.

However the telephone has its limitations. The telephone requires the interviewer to read out every question and this can be a tedious process, especially if there are 20 factors that must be rated. A question which asks people to spend points to determine the importance of different factors is difficult to administer on the phone. Faced with the same question online, the respondent can review all the factors, spend the points and the computer will do the maths, showing how many points have yet to be allocated.

Online surveys are a highly effective solution for trade-off exercises such as conjoint and MaxDiff. Surveys of this kind present respondents with numerous permutations of offers and ask which is preferred and which is not. Such questions would be impossible to read out over the phone as there could be 30 or so permutations to cover. Not only would it take an inordinate amount of time, the respondent would become punch drunk by the questions and not be able to distinguish one from the other.

Online surveys are also useful if it is necessary to show visuals or videos (as is required in concept testing or advertising research). They also provide anonymity for respondents which may be comforting if the subject of the enquiry is sensitive in any way.

-

The Target Audience

The target audience is a crucial consideration in determining whether to use the telephone or an online approach. The number of available contacts and the quality of the contact details will influence whether online research is possible. Quite clearly a contact list without up-to-date and personal email addresses would mean that telephone interviews is the only practical option. On the other hand, a list of up-to-date and accurate email addresses for an IT audience may make an e-survey the obvious choice as online platforms are their modus operandi.

Response rates to online surveys, aimed at a list of email contacts, varies significantly depending on the quality of the list and whether the respondents are “bought into” the subject. An up-to-date e-mail list of customers could generate a response rate as high as 30%. More typically response rates for e-surveys aimed at contact lists comprising a mixture of customers and potential customers, generate very low response rates, typically between 2% and 5%. Telephone interviews by comparison would yield between 10% and 25% from a similar list.

Many business to business markets are niche and are made up of a small number of contacts. In such cases, telephone interviews will be the preferred approach in order to obtain the maximum coverage from the restricted list.

We are also more likely to access the views of senior respondents over the telephone than online. That said, there will inevitably be some senior respondents who are prepared to take part in the survey but wish to do so in their own time and for them an online survey is preferable. This means that it is sometimes necessary to have a mixed methodology even though it incurs the additional cost of preparing an online option for just a few respondents.

Some markets still have little or no internet access and therefore are more suited to telephone interviews. Equally, in some regions, such as the USA, the audience is so over researched that few people will pick up the phone for a telephone interview. Here too online surveys may generate low response rates but a generous incentive may make them viable.

Whichever method is used, the researcher should always seek to obtain a representative cross-section of respondents. In other words, if the research method biases the responses to a particular audience, consideration should be given to a mixed methodology which would provide a better balance.

-

The Project Timelines

The timeline for the project may influence the choice between telephone and online interviewing. Online surveys are completed (in the main) within 48 hours of receipt of an invitation or they are not completed at all. A couple of reminders may be sent out but all this can be managed across a very large number of potential respondents in just a few days. In two weeks an online survey can generate hundreds of responses which would be a time consuming and laborious task by telephone. In the case of an international study, the online questionnaire can be quickly scripted and translated into appropriate languages. If such a study was to be carried out by telephone, it would require an army of trained nationals from different countries. As must be obvious, this would incur significant costs and associated quality problems.

-

The Budget Available

In many projects the budget can be the deciding factor in choosing the research method. In general, the more difficult the respondent is to contact, the greater the cost. In many cases seniority makes people difficult to contact. Senior people are often in meetings and may not value spending their time answering market research questions.

However, people who are not so senior but nevertheless have views that need to be collected may also be difficult to contact. We carry out a significant amount of interviewing with people who work in factories and on production lines and from them we find out their attitudes to personal protection equipment. These people are not on the end of a phone nor do they sit at a computer. Many trades people spend their days standing on ladders or working with gloves and with tools in their hands are not easily accessible to researchers. In these cases there is no easy solution as both telephone and online surveys will generate a low response. It is worth emphasizing that it is usually possible to get responses from the most difficult of people though at the expense of both time and cost. Some interviews cost hundreds of dollars to carry out and it is the difficulty of accessing the respondent rather than the length of the interview that determines the cost.

The Benefits Of Using A Multi-Method Approach

In the past decade it has become common to use a multi-method approach to projects. When different methods are used they should play to their strengths. It is not in usual in a business to business survey to carry out telephone interviews with the largest and most strategic customers and cover the rest with an online survey.

Summary

In summary, there is no simple answer as to which is best – telephone interviews or online surveys. Both have their place in b2b studies. The choice of method depends on the project objectives, the target audience, the timelines and the available budget. The strengths and weaknesses of these two important research approaches are summarized in the table below.

Figure 2: Online Versus Telephone Interviews – Which Is Best?

|

Online

|

Telephone

|

|

|---|---|---|

|

Getting answers to open questions

|

✔

|

✔ ✔ ✔

|

|

Getting answers to scale / rating questions

|

✔ ✔ ✔

|

✔ ✔

|

|

Conducting a longer questionnaire

|

✔

|

✔ ✔

|

|

Getting a higher response rate

|

✔

|

✔ ✔

|

|

Getting answers from a senior audience

|

✔ ✔

|

✔ ✔ ✔

|

|

Ensuring you are speaking to the right person

|

✔

|

✔ ✔ ✔

|

|

Fast data collection

|

✔ ✔ ✔

|

✔

|

|

Low cost interviews

|

✔ ✔ ✔

|

✔ ✔

|

Readers of this white paper also viewed:

Market Sizing: Is There A Market Size Formula? Market Segmentation in B2B Markets Using the Focus Group in Market Research