Focus groups have always been a popular research method in communication studies or ad testing. However, in business-to-business research, they are more niche and their use has declined in recent years. Is this because focus groups are not appropriate for today’s business to business marketer or is something else going on?

The truth of the matter is there are more research options available to business to business researchers nowadays. Online focus groups have become a serious contender. This paper discusses the merits of the online and face-to-face focus groups in business markets.

Traditional, face-to-face focus groups with business audiences have their challenges.

Challenge 1: Bums On Seats

One of the biggest challenges in face-to-face focus groups amongst business respondents is finding sufficient potential recruits within a 30 minute journey from a focus group venue. Even with a healthy financial incentive, people will not travel far to attend a focus group. They are simply not bought into the subject as much as the people who are commissioning the group. There must be at least 80 to 100 target respondents within a short radius of the focus group venue in order to recruit 10 people to a group. Of these, 6 to 8 will attend. Drop outs are inevitable as people decide they just can’t be bothered or there is a more important distraction at the last minute. Recruiting 10 small business owners to a focus group is unlikely to be a problem but it would be a struggle to locate and recruit 10 power plant operators.

Challenge 2: Paying The Price

B2b focus groups are not a low cost research option. Costs are made up of the incentives (usually $100 to $200 per person), the hire of the viewing facility, the recruitment of the respondents, the fee for the moderator and simultaneous translator (if the groups are international), and expenses for refreshments. Finally there is the fee charged by the market research consultants for carrying out the project and preparing the report. Focus groups amongst a business audience are harder to recruit and require a larger budget than consumer focus groups. They are likely to cost 50% to 100% more.

Challenge 3: Quality Not Quantity

Challenge number three is recognising that the output from each focus group includes the views and opinions of only a small sample of the target market. Therefore, whilst focus group discussions enable deeper exploratory insights than other methods, this advantage may not compensate for the narrow and possibly biased result from just one or two focus groups. Focus groups on their own may not provide all the evidence required to address a marketing problem – they may simply be a prelude to a wider study that involves a substantial number of interviews.

Challenge 4: The Great B2B Moderator

A fourth challenge is finding a great moderator for the groups. A good moderator determines a good focus group. The moderator must, of course, understand the technicalities of the subject. They must speak the jargon and know what it means when it is used by respondents. They will have to work hard to get responses from participants who are shy or say little. Equally, they must manage those who have found a soapbox and want to dominate the discussion. The moderation has to be with charm and friendliness that encourages the group to gel. All this while being viewed critically from behind the mirror. It isn’t easy.

Challenge 5: Keeping Things Flowing

B2b focus groups are frequently used for testing adverts and particularly testing concepts. The concepts could require visuals or prototypes to be unveiled at appointed times in the discussion. Because we are talking about business focus groups, some of these prototypes and products could be sizeable and introduce practical considerations. It may be easy enough to introduce catalogues or datasheets for people to look at during the group but if there are gas cylinders to examine, new boilers to look at, or plastic pipe to discuss, they may be more difficult to show. Meticulous planning is required to make sure that the products are delivered on time to the venue, that the venue has the capabilities of receiving and storing them until the time of the focus group, and that the room is big enough to house everything. At the end of the focus group everything that has been displayed will need to be removed because for sure, the room will have been booked by someone else for use the next day.

The Future For b2b Focus Groups Lies Online

Focus groups uniquely enable clients to physically observe the reactions of respondents in their target market. However, because of the various challenges mentioned, it is not surprising that only a minority of business-to-business clients adopt focus groups as their preferred qualitative research method. So where does this leave the future of business-to-business focus groups?

An emerging trend in business-to-business research is the use of online focus groups. Online focus groups are a practical alternative to traditional face-to-face groups. Although the ability to physically observe respondents in person is lost, online focus groups overcome many of the challenges previously mentioned and as such, may be better suited to some business-to-business projects. If we revisit the previous challenges mentioned, we can compare the two approaches.

Revisiting Challenge 1: Bums On Seats

As discussed earlier, it might be difficult to recruit a niche audience to a single geographical location. On the other hand, an online focus group allows for geographical dispersion of respondents across multiple cities or countries, as they simply need to log-in to the group from wherever they are located. This makes it easier to recruit dispersed and difficult-to-reach decision-makers to an online forum. The only caveat is that all would need to communicate in the same language.

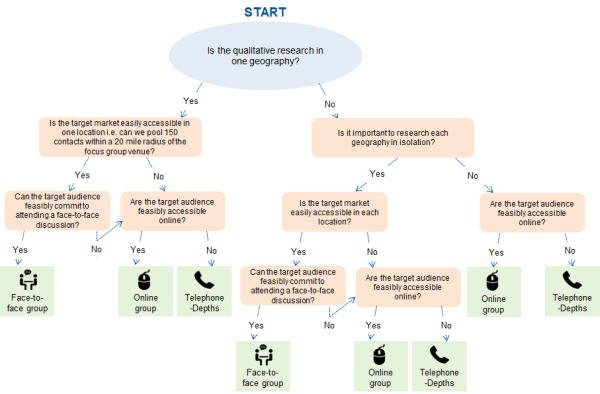

The following diagram shows how the geographical concentration (or otherwise) of the target audience will determine whether a face to face or online focus groups is possible.

Revisiting Challenge 2: Paying The Price

In theory online focus groups should offer cost efficiencies as there is no need for the hire of a physical venue. However, an online focus group requires moderation over a longer period of time. Participants in the online focus group take part over a couple of days. They sign into the group when they have time and join in the discussion as it develops. The moderator is vigilant and constantly looking at the dialogue as it develops. The moderator will comment and encourage some of the observations, urge people to take part who have been silent for a while, and sometimes challenge or ask for deeper explanations. The extra time required by the moderator in an online focus group more than balances out any savings that are made by not having to use a physical venue.

Online focus groups very often have more participants than is the case in a face-to-face focus group. It is not unusual to have 15 to 20 people take part in an online group. This means that the cost of recruiting and incentivising respondents for an online focus group will be higher than in a face-to-face group.

On balance, it is fair to say that the cost of an online focus group and a face-to-face focus group is approximately the same although the cost per participant joining in the online focus group may well be less.

Revisiting Challenge 3: Quality Not Quantity

Traditional face-to-face focus groups work best when there are 6-8 respondents. This is the optimum size of a group in a single setting. A focus group with a dozen or more participants could be counter-productive as a group of this size is difficult to moderate. Within the 90 minutes allotted time it is necessary to get the views of everyone in the room. When the group is too large, only a handful of participants will take the opportunity to really open up and say anything of note.

In contrast, online focus groups lend themselves to more flexibility. As these are set up like a forum with various topics lined up, each respondent can comment in their own time. The group remains open for a couple of days to allow respondents to feedback their comments. Respondents simply log-in and out, day or night, at their convenience, posting their views on the various topics, as well as responding to questions and comments of the other participants. This means there is scope to recruit up to 25 respondents (rather than 10), increasing the sample size and market coverage.

Revisiting Challenge 4: The Great B2B Moderator

The online business-to-business focus group moderator requires many of the skills of the face-to-face moderator. It is still crucially important that the online moderator is familiar with the subject matter as this allows them to facilitate the discussion with credible input and questions. Similarly, they need to ensure that they are engaging business-to-business respondents in order to keep the discussion flowing. This might involve directing specific questions to individuals or it may involve wider communication such as sending emails or telephone reminders to encourage increased participation from those offering less input.

Online focus groups are less spontaneous than face-to-face groups. In face-to-face groups, respondents respond immediately to statements or ideas allowing the moderator to judge the mood. Online the responses are more considered and they are usually well-balanced. The views tend to be honest and less inhibited than those offered in the physical presence of others.

Revisiting Challenge 5: Keeping Things Flowing

Online focus groups do not lend themselves to the physical testing of prototypes, as might be possible in a face-to-face setting. However, even if a physical product cannot be touched by participants of an online focus group, they can look at diagrams, photos, videos and other images which describe a concept or a prototype. Furthermore, it is easier to control the reactions to these images in an online focus group because the moderator can decide at what point the feedback is shared with everyone rather than kept private.

The online focus group provides a facility for poll questions which can be a good stimulus for further discussion. For example, the group may be asked to rate their interest to a particular concept, the results of which can be shared and become a subject for debate.

So, What’s The Future For Online Focus Groups?

Online focus groups will not replace face-to-face group discussions in business-to-business markets but they are sure to take more share. The decision to choose one rather than another may be determined by personal preference. For example, a research sponsor may feel strongly that observing a live discussion is of critical importance in building an understanding of the subject.

Ultimately, both approaches have their merits and drawbacks. They simply play to different strengths, depending on the context in which they are used. The chosen approach needs to bear in mind the research objectives, the target audience, their accessibility and the required outcomes.

The growing trend towards online focus groups and online research methods in general, leads us to expect an increased use of online focus groups to take advantage of their versatility and flexibility. They might not be a replacement for face-to-face groups, but they are most definitely a complementary methodological option to their face-to-face predecessor.

Readers of this white paper also viewed:

Market Sizing: Is There A Market Size Formula? Market Segmentation in B2B Markets Using the Focus Group in Market Research