Identify the best targets for acquisition through our thorough and structured process. Independently test assumptions that underpin your acquisition business case.

Acquisition research: Insights to inform your acquisition strategy

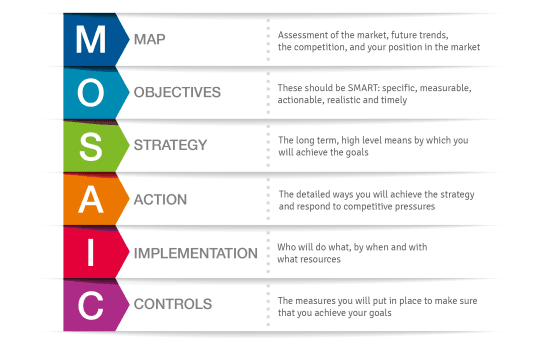

Our approach: The MOSAIC Model

-

Making informed M&A decisions requires a thorough analysis which covers micro and macro insights which lead to strategic and tactical actions.

-

Our proprietary MOSAIC framework can be followed to ensuring that you deliver a high ROI on your acquisition research investment, when considering or planning for an acquisition, merger or joint venture.

-

Effective acquisitions require a clear set of objectives and a foundation of insights, provided by our research. The strategy is the plan by which the objectives will be achieved. A detailed action plan is required as to who will do what, by when and the resources needed.

-

The Implementation stage is arguably where plans are most likely to fail. Successful implementation requires support at all levels and especially from the top of the business. Finally, controls must be in place to ensure that the actions are implemented. The controls will point to a need for a change in direction, should this be required.

Case study: Assessing the potential of a breakthrough gas detection technology and the pending acquisition of the technologies’ manufacturer

A leading supplier of safety technology products approached us prior to a potential future acquisition of a manufacturer of a unique gas detection technology. The client wanted to find out, whether there was sufficient market potential for the new technology and subsequently if the acquisition would be worthwhile or not.

The product potential was assessed by gathering acquisition research insights on the following:

- Current usage, as well as needs and unmet needs from safety technology suppliers

- Competitive landscape

- Current market size of traditional technology

- Customers’ reactions to the new concept (= new technology), willingness to purchase and willingness to switch

- Understanding the underlying motifs (why interested / why not?)

Our Clients